I Would Benefit From Continued Growth

nzphotonz/iStock via Getty Images

Industry overview

Continued strong demand for digital transformation

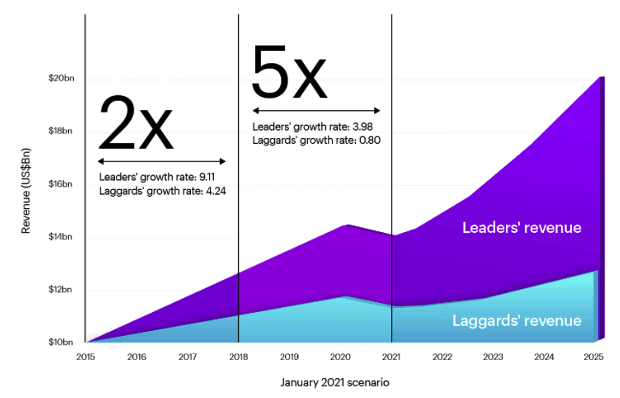

As I previously wrote, industry research from Accenture showed that even before the COVID-19 outbreak, leaders in digital transformation grew two times faster than digital laggards (figure 1). The COVID-19 pandemic has forced companies to increase spending in technologies that enable them to quickly adapt to and add value in a world in which the online shift has accelerated. Accenture estimates that the achievement gap between digital leaders and laggards has widened to five times since the COVID-19 outbreak, and it is poised to widen even more.

Figure 1: Digital transformation leaders have extended the revenue gap over laggards

Accenture Research

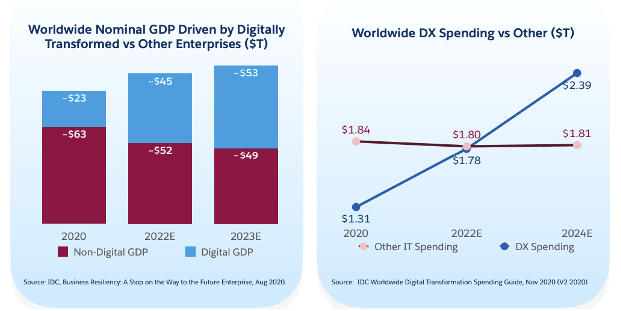

Data from Salesforce corroborates this observation, showing that worldwide GDP driven by digitally transformed enterprises has doubled but shrunk for non-digital enterprises (Figure 2, left chart).

With leaders stepping up their investment in technology and innovation, worldwide digital transformation spending is expected to increase by 35%, or ~16% p.a., to $1.78 trillion in 2022 (right chart). As digital transformation laggards are forced to jump on the digital transformation bandwagon and spend to play catch-up or risk extinction, IDE expects digital transformation spending to increase from $1.78 trillion to $2.39 trillion, or another 34% or ~16% p.a., between 2022 and 2024.

Figure 2: Digitally transformed enterprises: impact on GDP and spending

IDC, from Salesforce investor presentation

Companies have no choice but to continuously upgrade their digital capabilities to stay abreast of the competition. Eric Clemons, a professor at the Wharton School, nicknamed this the "Red Queen Principle" after a race described in Lewis Carroll's Through the Looking Glass. He illustrated this concept by telling the story in which the Red Queen and Alice were both running furiously in the same spot. The Red Queen said to Alice:

"My dear, here we must run as fast as we can, just to stay in place. And if you wish to go anywhere you must run twice as fast as that."

In this race towards digital transformation, companies run furiously just to stay in place. The arms dealers (or providers of picks and shovels, if you prefer), end-customers, and society are the winners.

The necessity of outsourcing

An organization's digital transformation requires major upgrades to both its software and hardware systems. This may include the rollout of an entirely new customer experience platform (as Starbucks did before the COVID outbreak), manufacturing operating system (AirBus), customer relationship management system (e.g., Sonos), or electricity transmission grid digital twin system (as provided by Bentley Systems). In the process, the organization's end-user access devices (ranging from connected PCs to tablets and smartphones), software, networking infrastructure, cloud services, cybersecurity, and IOT (internet of things) systems also need to be revamped.

Except for the deepest-pocketed organizations, firms going through digital transformation generally cannot justify bringing in the top specialists in-house to build best-in-class systems, nor are they likely to be able to provide its employees with an environment to stay on top of the latest trends, technological developments, or best practices within the industry.

In contrast, outsourced providers can afford to spend money to hire the best teams, to build deep IP (intellectual property), on R&D, or to buy knowhow through acquisitions as they can spread the cost over as many clients as they can sell to. As the incremental cost of selling existing intellectual knowhow to each additional client (beyond implementation labor, which can be billed to clients) is near zero, outsourced firms can derive highly attractive returns on their investment in IP. Apart from truly proprietary systems (e.g., trading algorithms for a commodity trading firm), it is difficult for organizations to justify the cost of developing IP internally that they are unable to share with others.

This applies to both software and hardware. Accenture's (NYSE:ACN) heavy R&D spending and cost of its high pace of acquisitions (reportedly more than one every week) can be spread across its relevant client base. Similarly, the cost for a systems integrator (like CDW Inc's (NASDAQ:CDW) Sirius Computer Solutions division) to develop and maintain best-in-class design and implementation practices can be spread across multiple clients it serves.

Economics characteristics of IT outsourced service providers

Gross margins of outsourced providers should hold up if the IT outsourced providers continue to deliver consistent value to clients. As their client base grows, R&D and acquisition amortization costs can be spread over an increasingly larger revenue base, so we can expect consistent margin expansion from operating leverage over time.

Size and scale matter - the largest IT outsourced service providers not only have deeper pockets and more resources with which to develop or acquire technology, but they have more clients to distribute their IP and technology. This can lead to a higher return on their investment, which they can in turn re-invest to build more and better IP, continuing a virtuous cycle that leads to a sustainable competitive advantage.

Two leading players in IT outsourcing: Accenture and CDW

Accenture: outsourced builder of digital core and business transformation capabilities

Overview

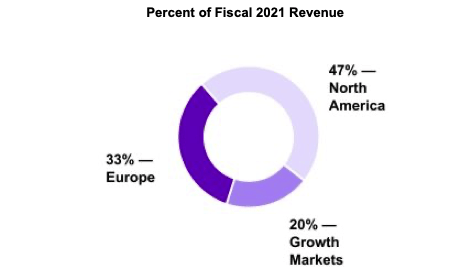

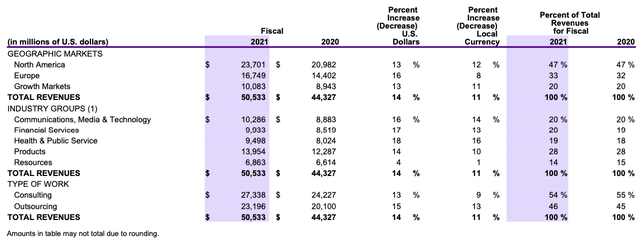

With revenues of $50.5 billion and 624,000 worldwide (as of August 31, 2021), Accenture is a leading global professional services company that helps clients build their digital core, transform operations, and accelerate revenue growth. Accenture is technology-agnostic - it partners with a broad range of hardware, software, and cloud vendors to deliver the most appropriate solution to its clients. The company has built deep expertise and a well-diversified revenue stream in five industries - communications, media & technology (~20% of 2021 revenue), financial services (~20%), health & public service (~20%), products (~25%), and resources (~15%), and it serves clients in North America, Asia Pacific, Latin America, Africa, and the Middle East (figure 3)

Figure 3: Geographical breakdown of Accenture's revenues

Accenture 2021 Form 10-K

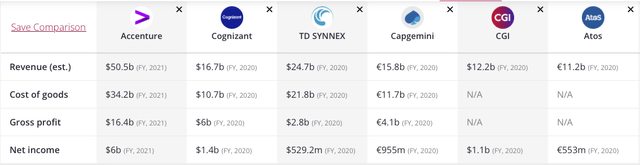

Cost of Accenture's rich and growing intellectual property can be spread across its large client base

Accenture provides clients with capabilities encompassing strategy, interactivity, technology, and operations by drawing from the rich intellectual property that resides within its network of more than 100 innovate hubs. The company continues to keep ahead of the competition by investing in strategic acquisitions ($4.2 billion across 46 acquisitions in 2021), research & development ($1.1 billion), and in its people ($900 million in professional development). The $2 billion Accenture spent on R&D and people development annually is orders of magnitude large than the annual net income of some of its major competitors (figure 4).

Figure 4: Summary financials of Accenture's key competitors

craft.co/accenture/competitors

As the incremental cost of implementing existing intellectual property for each additional client is near zero, Accenture can provide the same intellectual property to and amortize the development or acquisition cost over multiple clients, making it far cost effective for clients to outsource all but their most proprietary software algorithms to Accenture.

Record of long-term revenue growth

From FY 2020 to 2021, Accenture's revenue grew in the teens across all geographies, industry groups (other than natural resources), and types of work (figure 5).

Figure 5: Accenture revenue growth 2020-21 (for FY ended August 31)

Accenture 2021 Form 10-K

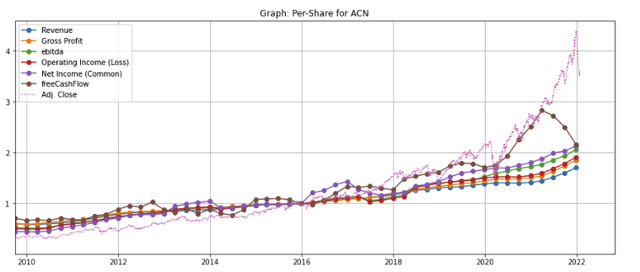

More importantly, over the last 12 years and on a per-share basis, Accenture's revenue has grown consistently (figure 6, blue line), and was outpaced by gross profit growth (orange line), which in turn was outpaced by EBITDA growth (green line) and free cash flow growth (brown line).

Figure 6: Accenture per-share financials (indexed)

created by author using publicly available financials

CDW: outsourced hardware, software, network, and cloud infrastructure provider

Overview

CDW began in 1984 as a re-seller of computer hardware, software, and peripherals. Today, it is leader in the integrated technology outsourced solutions provider sector. It serves a diversified client base consisting of businesses, government, education, and healthcare customers, and sits in an hourglass distribution system between more than 100,000 products from over 1,000 of brands and 250,000 customers.

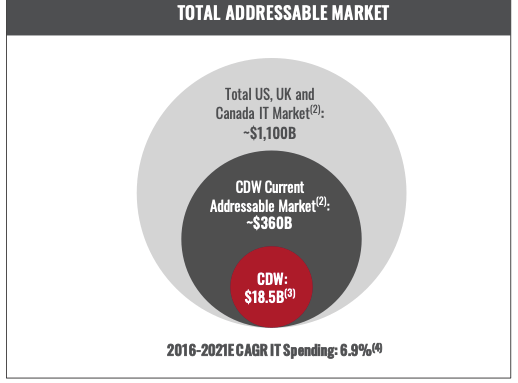

With revenues of $20 billion, it is twice the size of Insight Enterprises (NSIT) - the next largest publicly listed competitor. However, the sector remains highly fragmented - CDW, together with its next three largest IT solutions providers (Insight, PC Connection (CNXN), and e-Plus (PLUS)), represent less than 10% of the addressable market (figure 7). As such, there is room for leaders to grow market share and consolidate the space.

Figure 7: CDW's total addressable market

CDW company presentation

CDW's shift towards higher value added systems integration services

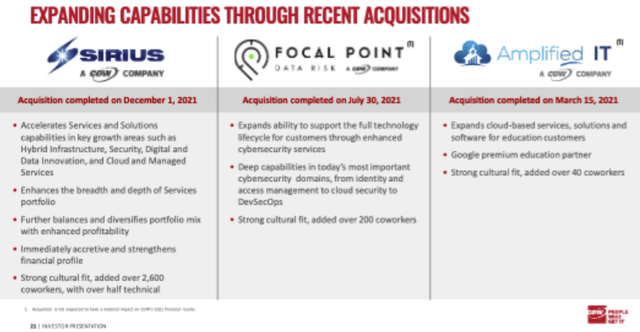

Over time, CDW has shifted from selling discrete technology products to providing integrated technology solutions that includes technology road-map planning, design, installation, ongoing maintenance, support, and system upgrades. CDW first entered the value-added reseller space in 2006 with the acquisition of Berbee - a top tier reseller of IBM, Cisco, and Microsoft products and services that provided network infrastructure, systems & storage, application development, security, and data centers that provided application hosting, co-location, and managed services. It has continued to expand its capabilities through additions acquisitions, most recently of Sirius, Focal Point, and Amplified IT (figure 8)

Figure 8: Recent CDW acquisitions to expand its value-add capabilities

CDW company presentation

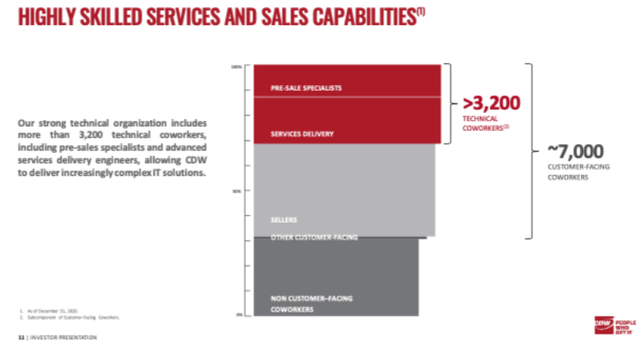

CDW notes that its "sweet spot" is customers with less than 5,000 employees. These are the customers which, as I noted above, are least likely to be able to attract and retain employees with the best specialized skills and talent. To support its business model shift into the higher value-added segments, CDW has increased its hiring of technology engineers and specialists. Today, almost half of CDW's customer-facing coworkers are technical staff (figure 9), which it is able to attract and maintain by spreading the cost over its diverse client base and provide the technical staff with opportunities to continuously sharpen their skills by working on a variety of client sectors and IT environments.

Figure 9: CDW technical coworkers constitute a significant proportion of CDW's staff

CDW company presentation

By providing clients with planning, design, installation, and support across the entire IT life cycle, CDW has been able to create long-term, sticky customer relationships. The ongoing business model shift has helped build CDW into a leading IT solutions brand. In 2019, it was ranked the fifth-best solutions provider out of 500 by Computer Reseller News (CRN).

Record of long-term revenue growth

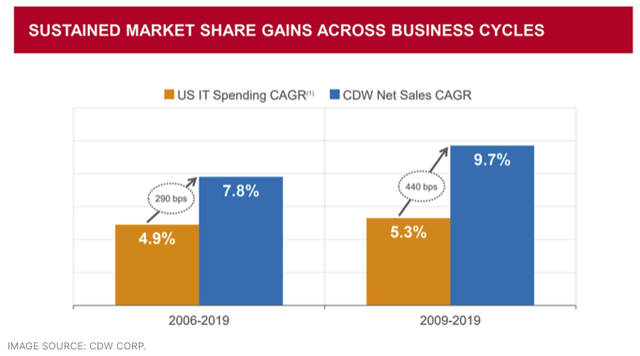

US IT spending in CDW's target market has grown in the mid-single digits per the last 15 years, but CDW's net sales has gained share by outgrowing industry spending (figure 10).

Figure 10: CDW net sales has outgrown US IT spending

CDW company presentation

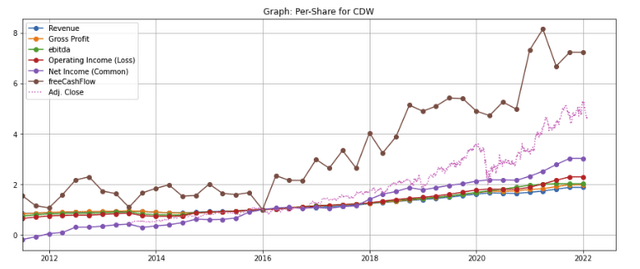

As CDW has been aggressively buying back shares (illustrated later in figure 13 below), its per-share revenues (figure 11, blue line) have grown even more quickly than net sales. Like Accenture, CDW's per-share revenue growth has been outpaced by its gross profit growth (orange line), which in turn has been outpaced by EBITDA, operating income, net income, and free cash flow growth (green, red, purple, and brown lines respectively)

Figure 11: CDW per-share financials

created by author using publicly available financials

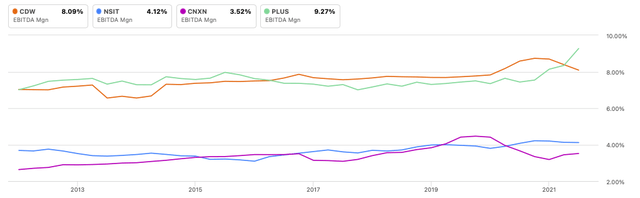

CDW margins compared to competitors

CDW's EBITDA margins (figure 12, orange line) has been higher than its competitors' - they have been higher than e-Plus (green line) and is twice that of Insight (blue line) and PC Connection (purple line).

Seeking Alpha charting

Comparative financial analysis

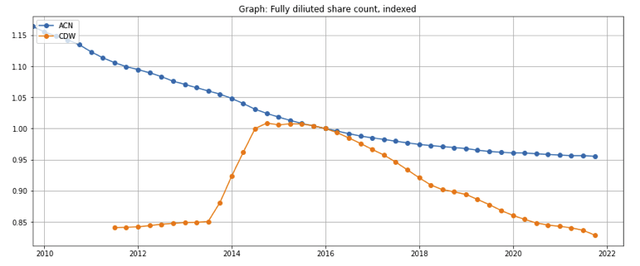

Fully diluted shares outstanding

Both Accenture and CDW have re-purchased shares over the years, but CDW has reduced its fully diluted share count by over 15% since 2016 (figure 13, orange line), compared to less than 5% for Accenture over the same period (blue line).

Figure 13: Accenture and CDW fully diluted share count

created by author using publicly available financials

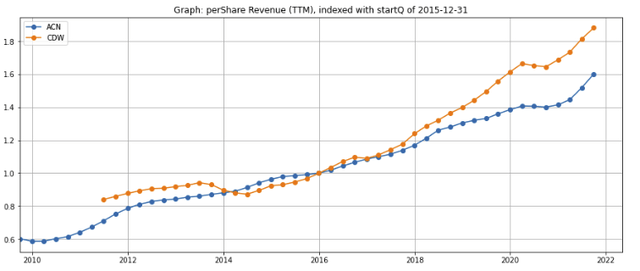

Per-share revenue growth

Even though the net sales of Accenture have kept pace with CDW since 2016, CDW's per-share revenues (figure 13, orange line) has grown significantly faster than Accenture's (blue line) due to the share buybacks.

Figure 13: Comparative revenue per-share growth (indexed)

created by author using publicly available financials

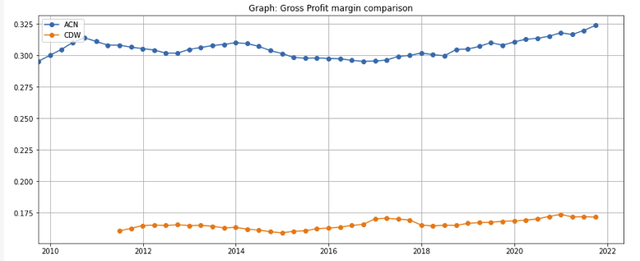

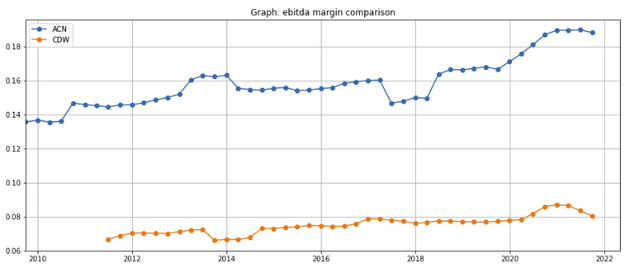

Expanding margins from operating leverage

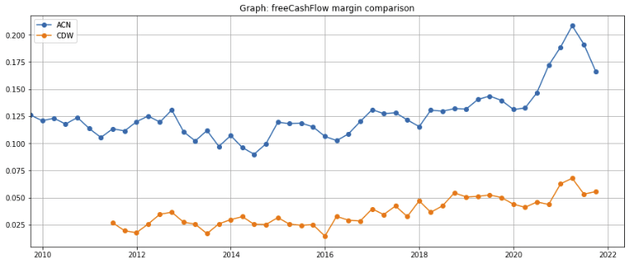

Over the last decade, the gross margins for both Accenture and CDW have generally held steady (figure 14). However, EBITDA and free cash flow margins (figure 15 and 16) have expanded, which is a consequence of the operating leverage inherent in their business models. Barring any major potential disruption in the industry, I believe it is highly likely that the EBITDA and free cash flow margins will continue to expand.

Figure 14: Gross margins

created by author using publicly available financials

Figure 15: EBITDA margins

created by author using publicly available financials

Figure 16: Free cash flow margins

created by author using publicly available financials

Year to date performance

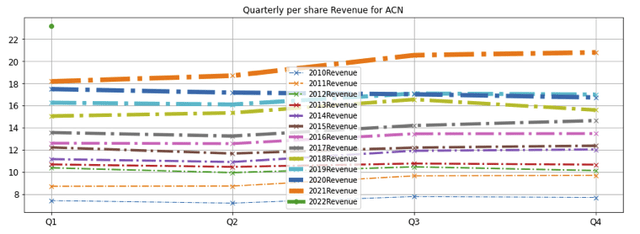

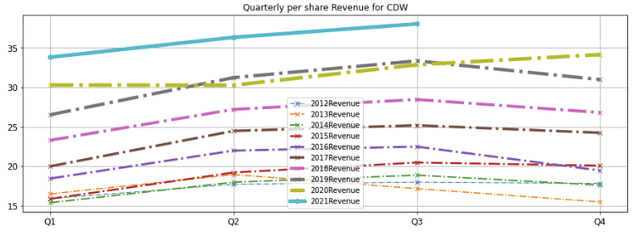

The per-share revenue growth of both Accenture and CDW slowed down in 2020 as the COVID outbreak put a temporary pause on IT spending. However, the revenue growth rates have rebounded strongly over the last three quarters (figure 17 for Accenture - orange and green lines; figure 18 for CDW - blue line)

Figure 17: Accenture quarterly per-share revenue

created by author using publicly available financials

Figure 18: CDW quarterly per-share revenue

created by author using publicly available financials

Financial Trajectory

Figure 19: Historical and future trajectory of key financial metrics

Historical Future Revenue Steady growth driven by need for digital transformation (figure 13) ↗️ Continued demand for digital transformation likely to fuel continued growth ↗️ Operating and free cash flow margins Operating leverage has fueled EBITDA and free cash flow margin expansion over the last decade (figure 15 and 16) ↗️ Operating leverage likely to drive continued margin expansion ↗️

Stock price and valuations

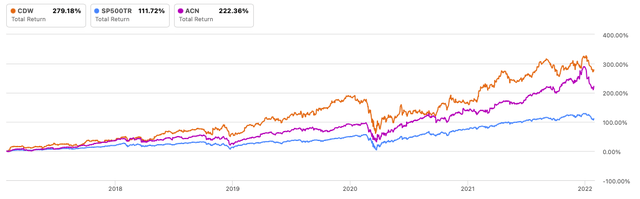

Over the last 5 years, both Accenture and CDW have outperformed the S&P 500 index by a significant margin. Both have delivered returns of 4x (including dividends) before the recent market sell-off (figure 20).

Figure 20: Total return of Accenture and CDW

Seeking Alpha charting

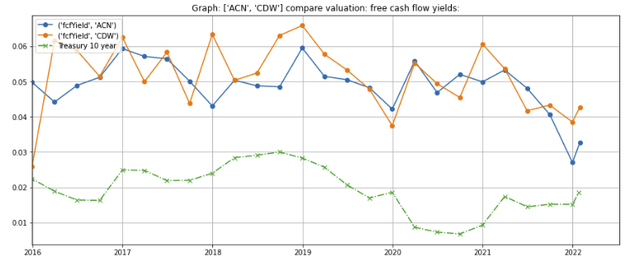

Even though both stock prices have come down following the recent market sell-off, valuations of Accenture and CDW are still at or near 6-year highs (figure 21, blue and orange lines). However, given CDW's growth rate, the stock's free cash flow yield of 4.3% (orange line) appears attractive even as 10-year treasury rates tick up (green dotted line) in response to the Federal Reserve's efforts to rein in inflation.

Figure 21: Free cash flow yield valuation

created by author using publicly available financials

Main Concern

Rising interest triggers slowdown in economy that crimps IT spending

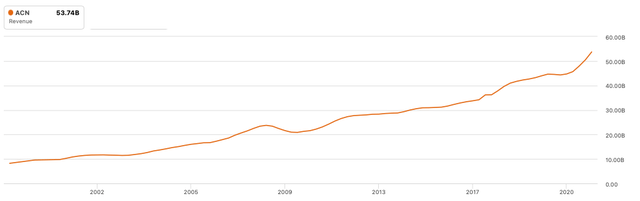

In spite of recessions and exogenous shocks, Accenture's revenues have increased more than fivefold over the last two decades and 2.5x since the great recession (figure 21). This demonstrates the robustness of Accenture's business model and strong need for companies to continue spending on IT to keep ahead of their competition.

Figure 21: Accenture's revenue has continued to grow steadily over the last 20 years

Seeking Alpha charting

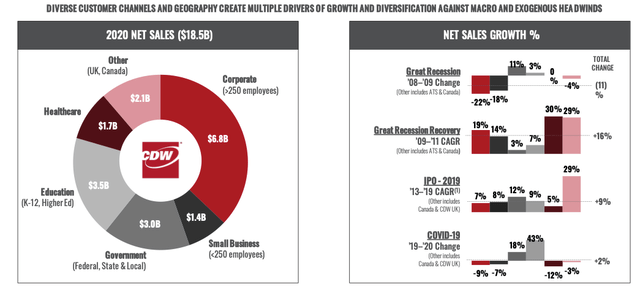

CDW's diversified exposure to multiple industries provides diversification against macroeconomic and exogenous headwinds (figure 22, left chart). For example, when the COVID-19 outbreak occurred, corporate, healthcare, and small business spending all declined (right chart), but the decline was more than offset by the increase in government and education spending, which enabled CDW to grow its revenues by 2% compared to 2019.

Figure 22: CDW customer diversification mitigates macroeconomic and exogenous headwinds

CDW company presentation

Conclusion

We are in the early innings of a digital transformation, which I expect to continue for the foreseeable future. IT outsourcing providers play a critical role in this process as they are typically able to provide best-in-class functionality to clients for less than it would cost their clients to build it internally. Furthermore, the margins of outsourcing providers should expand from operating leverage as they grow with the industry.

Accenture is a leader in helping clients build their core digital platform, transform operations, and accelerate revenue growth; while CDW is a leader in helping clients plan, design, install, and support their end-user access devices, network/cloud infrastructure and security.

Both are attractive companies, but valuations are relatively full and do not provide sufficient margins of safety. As such, I plan to build my position when the stock prices pullback.

This article was written by

I strive to unearth less obvious, overlooked, or under-appreciated but intriguing and potentially profitable data-driven insights into companies of service to society. I would be grateful if you call out blind spots, flaws, or gaps in my observations or reasoning. I hope you enjoy my contributions, but please do not take them as investment advice!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

mitchellouldn1976.blogspot.com

Source: https://seekingalpha.com/article/4483302-accenture-and-cdw-will-benefit-from-continued-growth

0 Response to "I Would Benefit From Continued Growth"

Post a Comment